The dividend payout ratio is a crucial metric for investors seeking income through dividends and for companies managing their cash flow. In this blog, we’ll delve into what the dividend payout ratio is, what is dividend payout ratio formula for share market, and its significance in the share market.

What is the Dividend Payout Ratio?

The dividend payout ratio represents the proportion of a company’s earnings that is distributed to shareholders in the form of dividends. It provides insight into how much money a company returns to its shareholders versus how much it retains for reinvestment in its operations, growth, or debt reduction.

The Formula for Dividend Payout Ratio

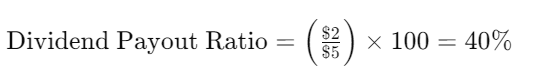

The dividend payout ratio is calculated using the following formula:

Let’s break this down:

- Dividends per Share (DPS): This is the total dividends paid out by the company divided by the number of outstanding shares.

- Earnings per Share (EPS): This is the company’s net income divided by the number of outstanding shares.

By dividing the DPS by the EPS and multiplying by 100, you get the percentage of earnings paid out as dividends.

Significance of the Dividend Payout Ratio

1. Investor Insight

For investors, especially those seeking regular income through dividends, the dividend payout ratio is a key indicator. A higher ratio suggests that a company is paying out a significant portion of its earnings as dividends, which might be attractive to income-focused investors.

2. Company’s Growth Strategy

A lower dividend payout ratio might indicate that a company is reinvesting more of its earnings back into the business for growth. This is common in growth companies that prioritize expansion over immediate returns to shareholders.

3. Sustainability of Dividends

The ratio helps assess the sustainability of a company’s dividend policy. A very high payout ratio may not be sustainable in the long term, especially if the company faces a downturn in profits.

Example Calculation

Let’s consider an example to illustrate the calculation:

Suppose Company XYZ has:

- Earnings per Share (EPS) of $5

- Dividends per Share (DPS) of $2

Using the formula:

This means Company XYZ pays out 40% of its earnings as dividends.

Factors Affecting the Dividend Payout Ratio

Several factors can influence a company’s dividend payout ratio:

1. Industry Norms

Different industries have varying norms for dividend payouts. For example, utility companies often have higher payout ratios compared to tech companies, which may reinvest more for growth.

2. Company Lifecycle

Young, growing companies typically have lower payout ratios as they reinvest earnings to fuel growth. Mature companies with stable cash flows may have higher payout ratios.

3. Earnings Stability

Companies with stable and predictable earnings are more likely to maintain consistent dividend payouts, leading to a stable dividend payout ratio.

4. Management Strategy

The management’s approach to balancing growth and shareholder returns significantly affects the payout ratio. Some management teams prioritize returning capital to shareholders, while others focus on reinvestment.

Evaluating the Dividend Payout Ratio

When analyzing the dividend payout ratio, consider the following:

- Consistency: Look for consistency in the payout ratio over several years, indicating reliable earnings and dividend policies.

- Comparison with Peers: Compare the ratio with industry peers to understand if the company is aligned with industry practices.

- Growth Prospects: Evaluate the company’s growth prospects. A lower payout ratio might be favorable if the company has strong growth potential.

Conclusion

The dividend payout ratio is a vital metric for both investors and companies. It provides insight into how much of a company’s earnings are being returned to shareholders as dividends and how much is being retained for future growth. By understanding and analyzing the dividend payout ratio, investors can make more informed decisions, and companies can better communicate their financial strategies.

Whether you are a seasoned investor or just starting, keeping an eye on the dividend payout ratio can help you identify stable, income-generating investments and understand a company’s financial health and strategic priorities.